SaaS construction collaboration vendor 4Projects grew its revenues 21% in the year ending 31 December 2014, but also reported the business’s first significant loss.

The Newcastle, UK-based SaaS construction collaboration technology vendor 4Projects (now Viewpoint for Projects) grew its revenues 21.5% in the year ending 31 December 2014. The UK subsidiary of Portland, Oregon, US-based Viewpoint Construction Software has filed its annual report and accounts at Companies House, and they show revenues increasing from £6.351m in 2013 to £7.717m (c. US$11.99m or €9.86m) last year, during which, in December 2014, the company acquired Mobile Computing Systems.

The Newcastle, UK-based SaaS construction collaboration technology vendor 4Projects (now Viewpoint for Projects) grew its revenues 21.5% in the year ending 31 December 2014. The UK subsidiary of Portland, Oregon, US-based Viewpoint Construction Software has filed its annual report and accounts at Companies House, and they show revenues increasing from £6.351m in 2013 to £7.717m (c. US$11.99m or €9.86m) last year, during which, in December 2014, the company acquired Mobile Computing Systems.

First loss

However, this acquisition does not account for the company’s first reported loss. After seven consecutive years of £1m-plus profits, the business has reported a pre-tax loss of £1.046m (c. US$1.62m or €1.34m) in 2014, compared to a £1.597m profit in 2013. The accounts show a sharp increase in headcount from 57 to 70, and a corresponding jump in payroll costs of around £0.9m, but these only partially account for the dip. The report explains this as follows:

“[There was] continued and sustained investment in all parts of the business. In particular the group invested significantly in R&D and growing our North American and Australian businesses to leverage our parent company’s significant presence in those markets. Given the subscription nature of our revenue the return on this intercompany investment will be felt more keenly in future years and in 2014 resulted in a planned accounting loss easily covered by our strong balance sheet.

Our investments in 2014 continue at a pace in 2015 and are already paying off in 2015 with strong growth continuing across all of the regions in which we sell.

4Projects saw revenues up around 14% in the UK (accounting for 75% of the company’s business), and up over 50% from the rest of the world, albeit from a relatively low starting point, said finance director Chris Baty. The Middle East was “undoubtedly strong”, and the growth had continued in 2015 (and “has the potential to accelerate again in 2016”). UK revenue growth is already accelerating, UK MD Alun Baker told me: “it’s above 20% and we’re seeing significant growth in infrastructure business”.

Product portfolio

As well as international expansion, the business has also been expanding its product portfolio, Alun said. “4Projects used to sell just a single product; now we have three new areas: our mobile capabilities, our BIM capabilities, and, in the US, integration into Vista ERP.” He said this was “proving increasingly attractive to many contractor customers who are now looking more strategically at their IT portfolio, looking to integrate documents, BIM, site activities and back office.” He also feels Viewpoint for Projects is the “SaaS leader in the BIM marketplace.”

As well as international expansion, the business has also been expanding its product portfolio, Alun said. “4Projects used to sell just a single product; now we have three new areas: our mobile capabilities, our BIM capabilities, and, in the US, integration into Vista ERP.” He said this was “proving increasingly attractive to many contractor customers who are now looking more strategically at their IT portfolio, looking to integrate documents, BIM, site activities and back office.” He also feels Viewpoint for Projects is the “SaaS leader in the BIM marketplace.”

The 4Projects integration of MCS’s former Priority1, now Field View, into the product porfolio is “proving compelling in the market place,” according to the report. Baker says it was an important milestone for 4Projects, and after unifying sales and support functions, rebranding and promoting the combined offer, “it’s proved a very successful acquisition for us, with 50% growth in revenues this year and big international interest”.

Price pressure?

I asked Alun about competitive pressures (highlighted by Conject UK in their recent annual report; post). Not naming names, he told me:

“We find some competitors in their native geographies are defending their positions at the market rate, but when it comes to winning work in other markets it’s different. In the UK, we’ve seen them offer significant – and, in our view, unsustainable – reductions.”

He underlined again the attractiveness of the integrated Viewpoint for Projects portfolio to contractors and other customers. “This is allowing us to sustain our price point, and we have seen an increase in both our average order value and the duration of contracts.”

Mindful of US GAAP reporting rules, he would not be drawn on the size of the business’s order book, but said the company had seen its net actual new contract value totals tracking at over 140% of plan. This was encouraging Viewpoint – buoyed by its investment from Bain Capital – to invest in maintaining the SaaS business’s revenues, as these were distinctly different in character to revenues derived from traditional perpetual licenses.

Commentary

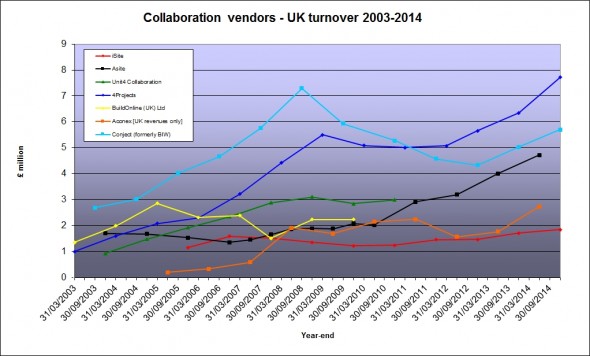

Allowing for the different reporting periods, ViewPoint for Projects’ 21.5% growth in 2014 plus its talk of accelerating growth in 2015, compares well to the 24% growth achieved by its international rival Aconex in the year to 30 June 2015. AEC SaaS vendors are growing revenues modestly in established markets such as the UK and mainland Europe (4Projects’ 14% UK growth is consistent with the 13% achieved by both Conject UK and Germany’s think project!), but – clearly – expanding into the Middle East and other developing markets is the key to significant revenue growth.

However, such expansion can hit profits. Australia-based Aconex’s experience suggests establishing a strong presence in a new market like north America requires significant investment in personnel and infrastructure, and attractive pricing to encourage early adoption. As a result, it may take time for that investment to generate a strong contribution to the bottom line (this Sydney Morning Herald article points out Aconex still lost Au$8m before tax [and accounting adjustments] in a market which remains a volatile ‘landgrab’ and where “being too conservative will almost certainly spell long term failure”).

I also note some convergence in the product strategies of these major players. With file sharing and document collaboration increasingly commoditised and rising competition at the SME end of the market (as well as ‘freemium’ solutions like GenieBelt, I have seen many low-cost solutions launched – a $15/user/month from BlueVue is just one recent example), the leading SaaS vendors are looking at the richer pickings of the enterprise market. They are marketing an expanded portfolio of services: workflow, mobile tools, BIM, integration with back office, business intelligence and financial reporting. With the UK government BIM mandate due to come into force in 2016 (and other countries following suit (eg: France 2017, Spain 2018), such more holistic offerings are likely to become more widely used. And the fruits of 4Projects’ prolonged investment in BIM could help boost its UK revenues, and make it attractive to customers and supply chains looking to deploy BIM in other markets.

9 comments

3 pings

Skip to comment form

4Projects drop their price pants just as much as any other vendor…….apart from Aside of course who give it away.

Paul following your lead regarding the “a little accounting magic” observation you used to describe Conject’s recent positive financial performance could this article fall under the ‘a little journalistic magic’ through the use of a positive headline to bury the underlying performance which saw a $2,500,000 plus profit in 2013 become a $1,600,000 loss in 2014? At this rate there maybe a role at FIFA for your journalistic magic skills 🙂

Author

IMHO, the revenue growth was more interesting than the profit/loss plunge (which, in any event, was well within 4Projects balance sheet capabilities – other vendors, including Conject UK, have not had the luxury of a decade of profitable trading).

And if I could exert magic in the football world, Crewe would not be propping up League One! 🙂

Do 4 Projects Viewpoint have any new major enterprise deals last 12 months? They seem to have a rats and mice strategy of picking up small accounts and surviving off their old business from years ago pre Viewpoint. Barely a sustainable business model, except as another product string in the bow of Viewpoint product suite, which is really nothing to do with collaboration. But strategically, they seem to be going nowhere with this collaboration product.

Author

Hi Amir

I am sure they will have signed some enterprise deals in the past year, but either chose not to publicise them, or were prevented by their clients from publicising them.

I disagree with you on their collaboration product. I have watched them expand their platform’s capabilities to embrace BIM and deliver a ‘Level 2’ common data environment (they are ahead of their UK competitors in this respect, and the UK market is world-leading in its industry-wide push to mandate BIM). This will position them well in a sector that is beginning to embrace BIM and to focus on data-sharing as opposed to old-school file-sharing.

Regards – Paul

I know it helps interest in the industry to tell a story that “Old School” early extranet players like 4Projects still have some relevance, but clearly as the previous commenter pointed out they don’t anymore, they’ve lost it. It’s an absurd idea, you suggest, that they’re signing up enterprise deals but have to keep them secret! Why would enterprise deal be secret, everyone has to know to be involved in the collaboration. They’re not signing much at all except UK and are spent force but for old business in UK. They’re a small bit in Viewpoint portfolio. A depressing 3rd rate place to work if interested in collaboration software for construction. RIP one of the early industry leaders.

Author

I know it may seem strange (and it’s frustrating to the vendor’s PR/marketing/sales/IR teams), JoeW, but some customers (including at least one well-known UK-based international contracting group) have a policy of not being seen to publicly endorse any supplier. Use of a preferred SaaS system, for example, will still be communicated privately to all supply chain partners, but the relationship can’t be the subject of a news release, or be included on a list of customers, etc.

Aconex has released another report to ASX which shows it’s now making lot more operational cash flow per annum than 4Projects has in total revenue.

Part of my due diligence on this industry was Roy Hill project, which is 4Projects biggest deal won for years. Viewpoint 4Projects more or less collapsed and were unable to serve the client.

Author

Interesting – I noted the change of provider to Roy Hill in April 2014.

[…] market leader Aconex announced revenues up 46%. In October 2015, Viewpoint for Projects reported 2014 revenues up 21% with 2015 revenue growth “above 20%” in the […]

[…] revenues by 12%, while Conject UK earlier grew 13% (post), Viewpoint UK-only revenues were up 14% (post) and Munich, Germany-based think project! reported in February (post) March that its 2015 revenues […]

[…] 2015 was a bumper year for Viewpoint‘s EMEA-based collaboration business, with revenues up 48% and a return to operational profitability. According to accounts filed at UK Companies House, total revenue for the year to 31 December 2015 was £11.457m (about US$16.84m or €15.58m at 2015 exchange rates) up from £7.717m in 2014 (post). […]